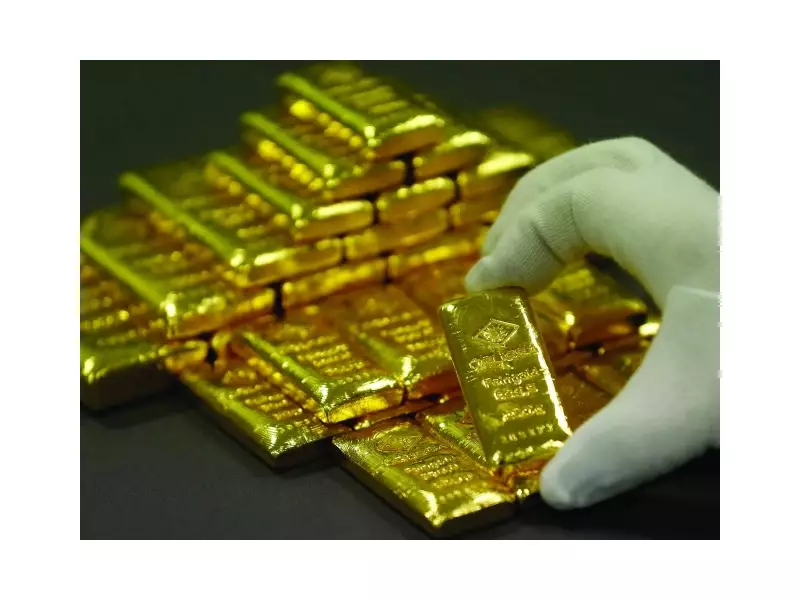

The federal government of Pakistan has announced a significant tightening of regulations around the trade of precious metals. This decisive action forms a core part of a broader strategy to strengthen the country's defenses against money laundering and the financing of terrorism.

New Oversight Regime for High-Risk Sectors

Under the newly enhanced framework, businesses involved in buying and selling precious metals will face much closer scrutiny from authorities. This increased oversight will also extend to real estate agents, dealers, and other professionals connected to these sectors. The goal is to ensure effective monitoring across all non-financial businesses and professions, which are often seen as vulnerable channels for illicit financial flows.

Officials from the Ministry of Finance confirmed that the State Bank of Pakistan (SBP) has already introduced a new monitoring system specifically designed to curb trade-based money laundering. This move directly responds to concerns previously raised by the International Monetary Fund (IMF), which had flagged Pakistan's exposure to risks from this type of financial crime.

Coordinated National Response and Upcoming Deadlines

The government's approach is highly coordinated. The Federal Board of Revenue (FBR), the State Bank, and the Financial Monitoring Unit (FMU) are jointly analyzing the economic impact of trade-based money laundering. A comprehensive National Risk Assessment report stemming from this review is scheduled to be shared with relevant institutions by March 2026.

In a parallel development, the Securities and Exchange Commission of Pakistan (SECP) established a Central Beneficial Ownership Registry in July 2025. This crucial database, which tracks the true owners of companies, is expected to become accessible online for financial institutions and law enforcement agencies by January 2026.

Building on FATF Progress

Finance Ministry officials highlighted that Pakistan's efforts are a continuation of its commitment to global financial standards. They noted that the country's removal from the Financial Action Task Force (FATF) grey list in October 2022 was a major milestone. However, they emphasized that the work is ongoing, with continuous implementation of FATF's conditions and recommendations remaining a top priority for the nation's financial integrity.