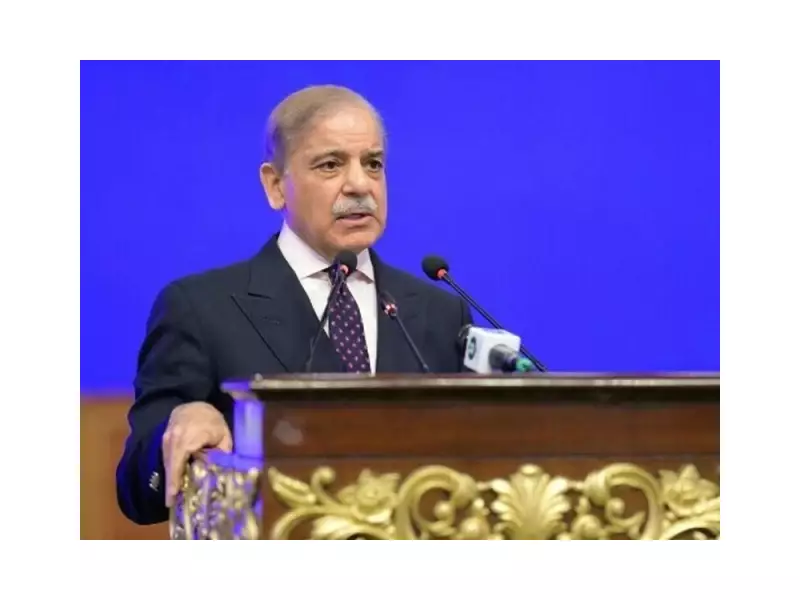

In a significant move aimed at providing substantial relief to the nation's taxpayers, Prime Minister Shehbaz Sharif has directed an immediate and comprehensive review of the country's current tax structure. The Prime Minister's intervention comes amid growing concerns about the burden of high tax rates on both the salaried class and the business community.

Immediate Relief for Taxpayers

During a high-level meeting focused on the Federal Board of Revenue's operations, PM Shehbaz Sharif emphasized the urgent need to address the challenges faced by taxpayers. The Prime Minister specifically called for measures that would provide immediate relief to those struggling under the weight of current tax obligations.

The directive represents a major policy shift that could significantly impact the financial landscape for millions of Pakistanis. The Prime Minister's office has made it clear that reforming the tax system is now a top priority for the government.

Comprehensive Reform Agenda

The review process will examine multiple aspects of the current tax regime, including:

- Income tax rates for salaried individuals

- Corporate tax structures affecting businesses

- Sales tax implementations and their impact

- Overall tax burden on different economic segments

The Prime Minister stressed that the ultimate goal is to create a more balanced and equitable tax system that supports economic growth while providing necessary relief to taxpayers.

Broader Economic Implications

This tax review initiative is part of a larger economic reform package being considered by the government. The move signals the administration's commitment to addressing one of the most pressing concerns of both individual taxpayers and the business community.

Experts suggest that a well-structured tax reform could stimulate economic activity, encourage investment, and potentially increase tax compliance through a more reasonable approach to taxation.

The Federal Board of Revenue has been instructed to work on implementing the Prime Minister's directives promptly, with expectations that initial recommendations could be presented in the coming weeks.